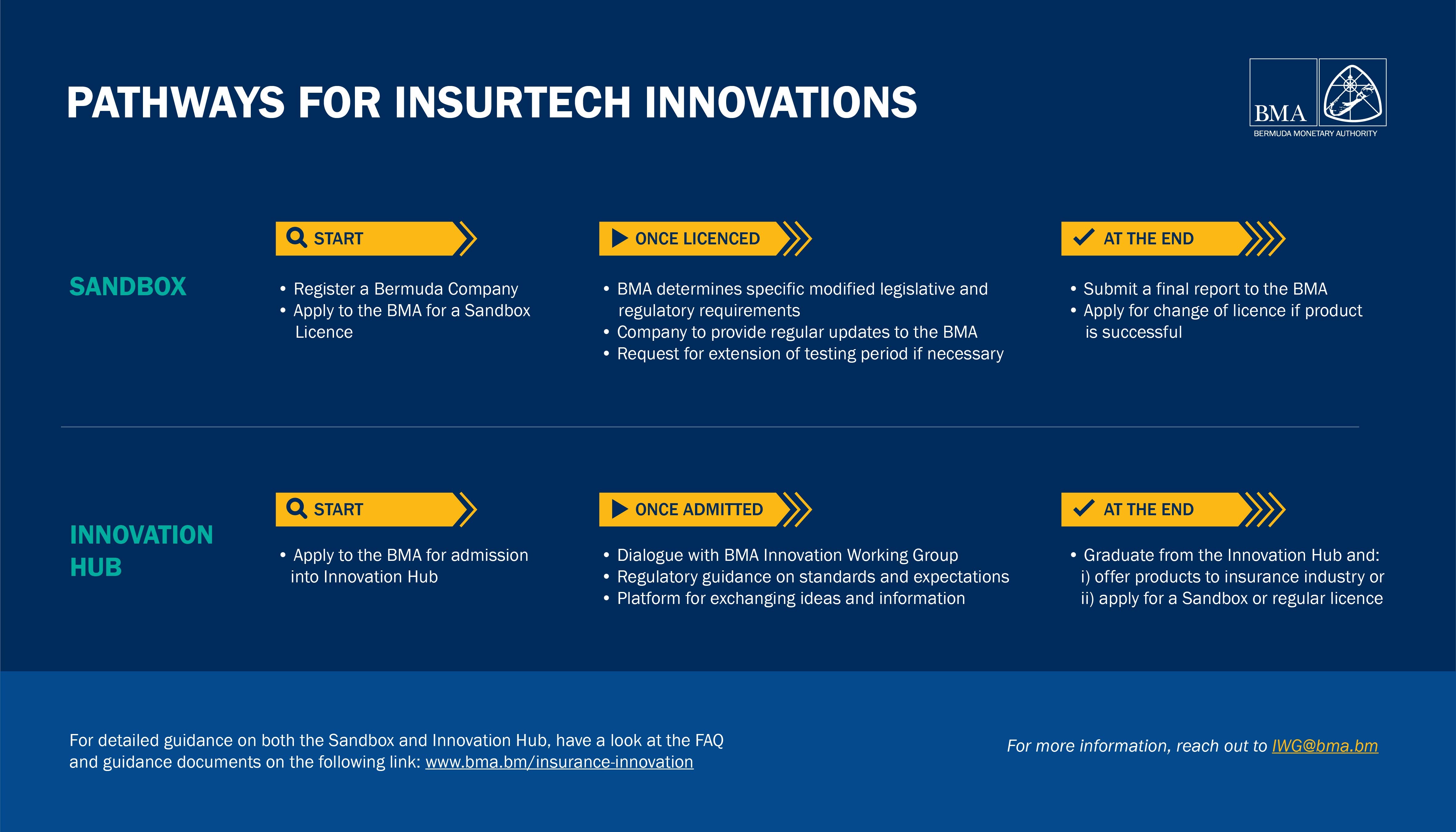

The BMA recognises the growing importance of innovation in the insurance and wider financial services industry, and the critical role that innovation plays in promoting efficiency and enhancing competitiveness in the market. Therefore, the Authority launched two parallel innovation tracks: an Insurance Regulatory Sandbox (Sandbox) and an Innovation Hub, both initially targeted at Insurance Technology (InsurTech) companies.

Insurance Regulatory Sandbox

The Sandbox is an innovation track for companies looking to test new technologies or business models on a limited number of clients in a controlled environment and for a limited period of time. The Sandbox is reserved for companies that will be undertaking licensable activities as defined under the Insurance Act 1978.

Participating Companies:

| Company Name | Sandbox Licence | Project Overview | Sandbox Licence Expiry | Sandbox Status |

| Ensuro Re Limited | Innovative Insurers - IGB | Ensuro utilises smart contracts to pool capital in the form of stablecoins from "Liquidity Providers" and provide underwriting capacity for Insurtech companies operating in the parametric insurance space. During the sandbox period the company is restricted to institutional “Liquidity Providers” only. Please note this company is also licensed under the Digital Asset Business Act 2018. |

1 January 2024 | Active |

| Standard Crypto Insurance -- Bitcoin (Bermuda) Limited | Innovative Insurers - ILT | Offers bitcoin-denominated long term insurance products. The project’s initial target clientele are high-net-worth individuals/sophisticated investors as defined under the Investment Funds Act 2006. | 29 December 2023 | Active |

| Breach Insurance, Ltd. | Innovative Insurers - IGB | Offers fiat-denominated and crypto-denominated insurance solutions for cyber theft exposures on select cryptocurrency exchange platforms. | 6 October 2023 | Active |

| Blackbird ILS Marketplace Ltd. | Innovative Intermediary - IMP | A closed-end liquid market for structured, syndicated and modelled cyber exposure and other specialty risk as fixed-income products. The market facilitates the trading of insurance-linked security bonds between insurers, reinsurers and sophisticated investors. | 8 September 2023 | Active |

| Chainproof Digital Asset Insurance Ltd | Innovative Insurers - IGB | Offers smart contract insurance against loss or theft of digital assets. The project’s initial target clientele are institutional asset managers for vetted decentralised finance (DeFi) systems. | 6 May 2023 | Active |

| Kettle Limited | Innovative Intermediary - IA | An insurance agent underwriting catastrophe coverage on behalf of target capacity providers using proprietary machine learning algorithms technology to create optimal portfolios of risk. The project's initial focus is on California wildfire exposures. | 12 March 2023 | Graduated Post-sandbox licence: Insurance Agent effective 19 August 2022 |

| Nayms SAC Ltd. (formerly Nayms Ecosystems Limited) | Innovative Insurers - IGB | A smart contract powered platform that allows insurance entities to create fully-collateralised, fully digital, transparent, trustless and tradable reinsurance contracts. Please note this company is also licensed under the Digital Asset Business Act 2018. | 1 May 2022 | Graduated Post-sandbox licence: Class IIGB effective 1 May 2022 |

| AkinovA (Bermuda) Ltd | Innovative Intermediary - IMP | An electronic marketplace to transfer and trade insurance risks, enabling cedants and intermediaries acting on their behalf to transfer insurance risk to investors | 26 December 2020 | Graduated Post-sandbox licence: Insurance Marketplace Provider effective 1 January 2021 |

Innovation Hub

| Project Name | Project Overview | Company |

| Aanika Insurance Agent | Aanika is seeking to develop insurance products, namely product liability, crop insurance and food/product recall, which incorporate their proprietary microbial tagging technology in their supply chain. | Aanika Biosciences, Inc. |

| Remitrix Edge and Remitrix Horizon | Modules using machine learning to improve the prediction and automation of the actuarial parameter setting process required for capital modelling by insurers and reinsurers. Initial focus is on European Union Solvency II and IFRS17 capital modelling. |

Remitrix Ltd. |

| Longitude Exchange | Longitude Exchange is seeking to be a marketplace for hedging, investing in and trading longevity risk leveraging quantitative insights and financial and data analytics. | Longitude Solutions LLC, and VB Risk Advisory B.V. |

| Fixed Risk Contract | Development of a regulated, non-negotiated capital markets product that mitigates the risk of property damage caused by natural disaster, by paying out upon recognition of a set of clearly defined circumstances. | Telluriq Investment Company Limited |

| Avert | Leveraging block-chain technology to build an automated insurance platform for captive insurance management to serve the digitally-native and blockchain-native business community | Mothership Holdings, LLC |

| RiCap BERMUDA | A blockchain-driven electronic platform allowing brokers, insurance companies and reinsurers to do business in a single platform to improve business efficiency and cut frictional cost (phase 1), as well as build a private business network to access third party capital (phase 2 and 3) | ChainThat Limited |

IMPORTANT LINKS:

- Guidance Note: Insurance Regulatory Sandbox and Innovation Hub

- Schedule a call with our Insurance Innovation team

-

- Insurance Regulatory Sandbox Application Form Checklist

- Sandbox and Innovation Hub Infographic: